🔎 Notes

📖 Berk, DeMarzo and Harford Sections 16.4 – 16.7

Financial Distress

The Bankruptcy Code

Chapter 7 - Liquidation

- Trustee is appointed to oversee the liquidation of the firm’s assets

- The proceeds are used to pay the firm’s creditors, and the firm ceases to exist

Chapter 11 - Reorganization

- Firm’s existing management is given the opportunity to propose a reorganization plan

- The reorganization plan specifies the treatment of each creditor of the firm

- If an acceptable plan is not put forth, the court may ultimately force a Chapter 7 liquidation of the firm

Direct Costs of Bankruptcy

Each country has a bankruptcy code designed to provide an orderly process for settling a firm’s debts

- However, the process is still complex, time-consuming, and costly

- Outside professionals are generally hired

- The creditors may also incur costs during the process. They often wait several years to receive payment Average direct costs are 3% to 4% of the pre-bankruptcy market value of total assets

- Likely to be higher for firms with more complicated business operations and for firms with larger numbers of creditors

Indirect Costs of Financial Distress

Difficult to measure accurately, and often much larger than the direct costs of bankruptcy

- Often occur because the firm may renege on both implicit and explicit commitments and contracts

- Estimated potential loss of 10% to 20% of value

- Many indirect costs may be incurred even if the firm is not yet in financial distress, but simply faces a significant possibility that it may occur in the future

Examples:

- Loss of customers - Customers may be unwilling to purchase products whose value depends on future support or service from the firm

- Loss of suppliers - Suppliers may be unwilling to provide a firm with inventory if they fear they will not be paid

- Cost to employees - Most firms offer their employees explicit long- term employment contracts. During bankruptcy these contracts and commitments are often ignored and employees can be laid off

- Fire Sales of Assets - Companies in distress may be forced to sell assets quickly

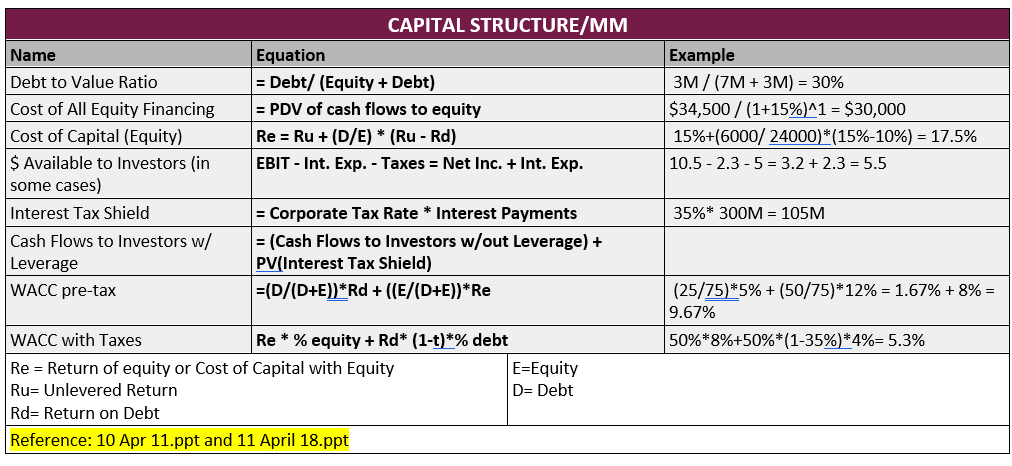

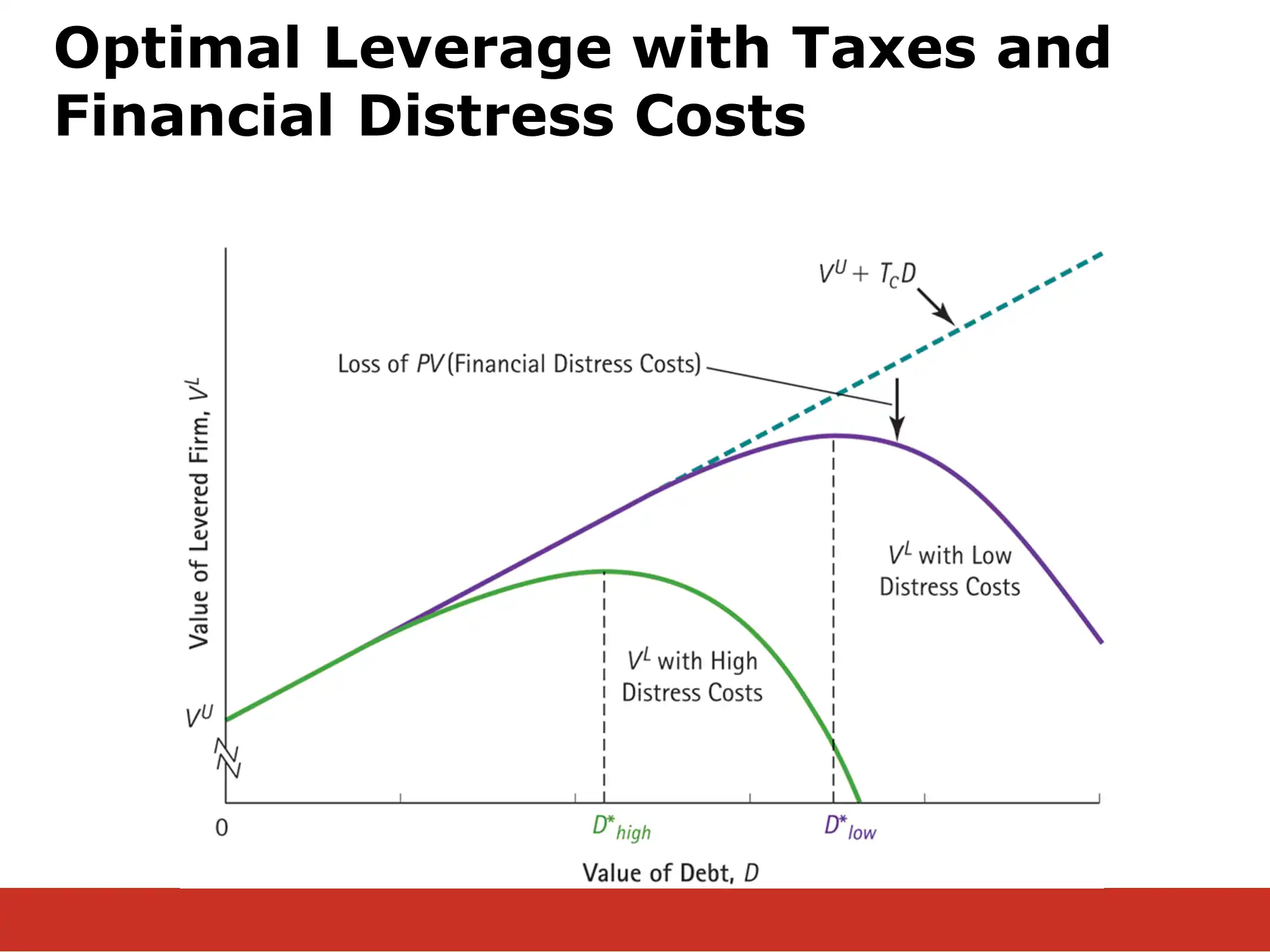

The Tradeoff Theory

Total value of a levered firm equals the value of the firm without leverage plus the present value of the tax savings from debt, less the present value of financial distress costs:

- As debt increases, tax benefits of debt increase until interest expense exceeds EBIT

- Probability of default, and hence present value of financial distress costs, also increases

- The optimal level of debt, D*, occurs when the value of the levered firm is maximized

- D* will be lower for firms with higher costs of financial distress

Optimal Leverage with Taxes and Financial Distress Costs:

The Tradeoff Theory helps to resolve two important facts about leverage:

- The presence of financial distress costs can explain why firms choose debt levels that are too low to fully exploit the interest tax shield

- Differences in the magnitude of financial distress costs and the volatility of cash flows can explain the differences in the use of leverage across industries

Key qualitative factors determine the present value of financial distress costs:

- The probability of financial distress

- Depends on the likelihood that a firm will default

- Increases with the amount of a firm’s liabilities (relative to its assets)

- It increases with the volatility of a firm’s cash flows and asset values

- The magnitude of the direct and indirect costs related to financial distress that the firm will incur

- Depend on the relative importance of the sources of these costs and likely to vary by industry

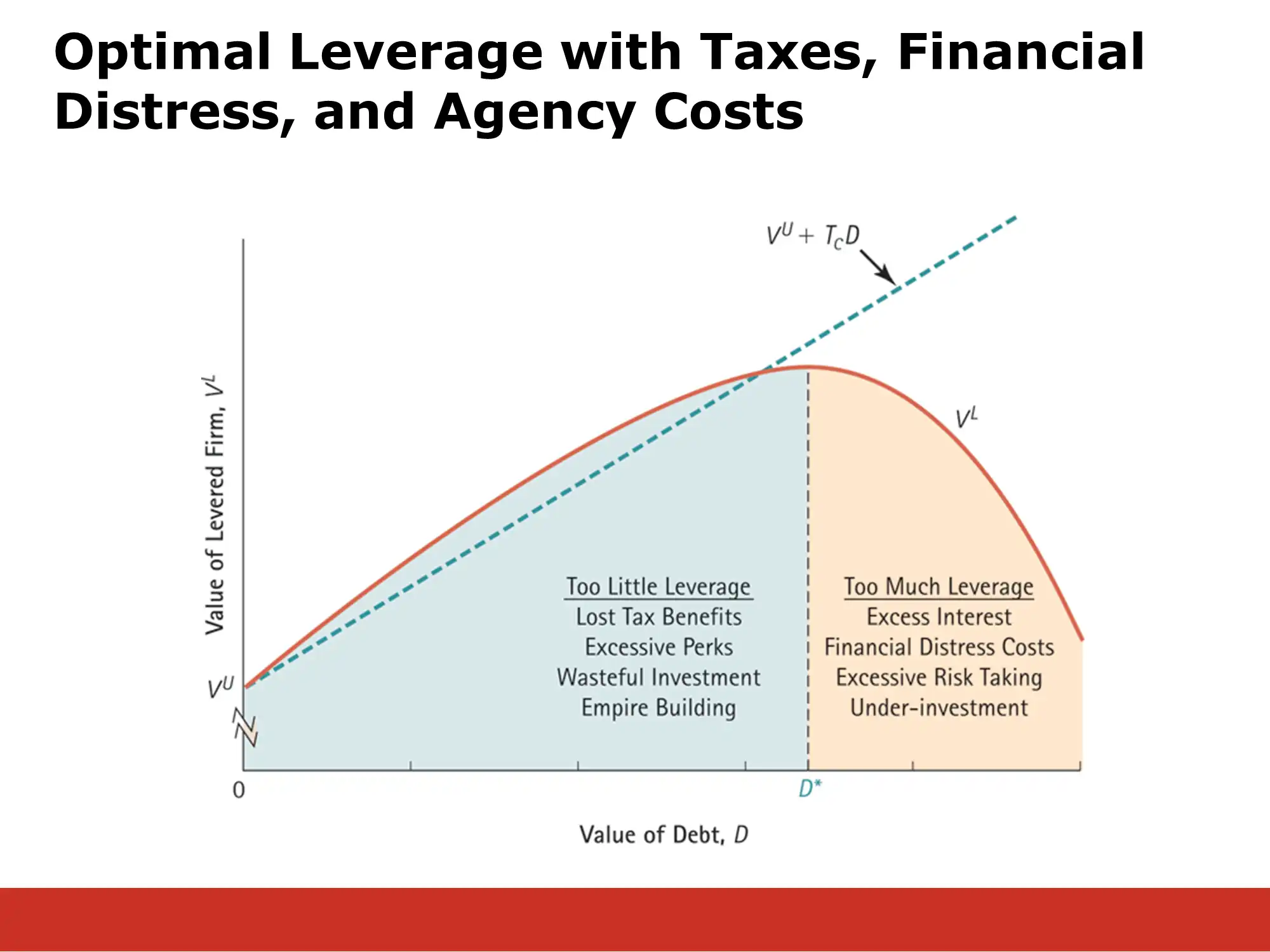

Agency Costs and Benefits

Agency benefits of leverage: ownership concentration and fiscal discipline

Agency costs are costs that arise when there are conflicts of interest between stakeholders.

We will focus on conflicts of interest between the managers and the owners. Managers are supposed to act as the “agents” of the owners. However, they may take actions that:

- Benefit themselves at investors’ expense

- Reduce their effort

- Spend excessively on perks

- Engage in “empire building”←ie, unnecessary M&A, that allows them to run a larger company. If these decisions have negative NPV for the firm, they are a form of agency cost

Debt provides incentives for managers to run the firm efficiently:

- Ownershipmay remain more concentrated, improving monitoring of management

- Since interest and principle payments are required, debt reduces the funds available at management’s discretion to use wastefully on perks and empire building.

Agency costs of leverage: conflicts between creditors and stockholders

A conflict of interest exists if investment decisions have different consequences for the value of equity and the value of debt

- Most likely to occur when the risk of financial distress is high

- Managers may take actions that benefit shareholders but harm creditors and lower the total value of the firm

- Managers are hired by the board, which is elected by shareholders.

Agency costs for a company in distress that will likely default:

- Excessive risk-taking

- A risky project could save the firm even if the expected outcome is so poor that it would normally be rejected

- See 🔎 Can leverage increase risk appetite? [yes] for details

- Under-investment problem

- Shareholders could decline new projects.

- Management could distribute as much as possible to the shareholders before the bondholders take over

Tradeoff Theory, Part II

Benefits of Leverage:

- Interest tax shield (TCD)

- Improvements in managerial incentives. Costs of high leverage

- Present value of financial distress costs

- Agency costs The optimal level of debt, D*, balances these benefits and costs of leverage

But wait… there’s more! Let’s add Asymmetric information to our model of the optimal level of debt, D*.

Asymmetric information

Asymmetric information about the prospects of the firm.

- Managers’ information about the firm and its future cash flows is likely to be superior to that of outside investors. By definition, managers have “inside information” that investors don’t have.

- Here we look at the consequences of this. It may motivate managers to alter a firm’s capital structure.

Leverage as a Credible Signal

- Managers use leverage to convince investors that the firm will grow, even if they cannot provide verifiable details.

- If the firm increases leverage without good prospects, the firm may experience financial distress. This would have negative personal consequences for management.

- Therefore, if management levers up, it is a “credible signal” that management think the firm has good prospects.

- This is known as the signaling theory of debt

Market Timing ⇨ Adverse Selection ⇨ The Pecking Order Hypothesis

- Market Timing

- Managers sell new shares when they believe the stock is overvalued, and rely on debt and retained earnings if they believe the stock is undervalued

- Adverse Selection/Lemons problem:

- Suppose managers issue equity when it is overpriced

- Knowing this, investors will discount the price they are willing to pay for the stock

- This is also known as a “lemon’s problem” based on the idea that if someone wants to sell you a used car, it’s probably a lemon.

- This lemons problem is most serious with equity, because management’s inside information is more important for equity.

- Managers do not want to sell equity at a discount so they may seek other forms of financing

- The Pecking Order Hypothesis states:

- Managers have a preference to fund investment using retained earnings, followed by debt, and will only choose to issue equity as a last resort

Example 1: The Pecking Order of Financing Alternatives

- Problem:

- Axon Industries needs to raise $9.5 million for a new investment project. If the firm issues one-year debt, it may have to pay an interest rate of 8%, although Axon’s managers believe that 6% would be a fair rate given the level of risk. However, if the firm issues equity, they believe the equity may be underpriced by 5%. What is the cost to current shareholders of financing the project out of retained earnings, debt, and equity?

- Plan:

- We can evaluate the financing alternatives by comparing what the firm would have to pay to get the financing versus what its managers believe it should pay if the market had the same information they do.

- Execute:

- If the firm spends $9.5 million out of retained earnings, rather than paying that money out to shareholders as a dividend, the cost of financing the project is $9.5 million.

- Using one-year debt costs the firm $9.5 (1.08) = $10.26 million in one year, which has a present value based on management’s view of the firm’s risk of $10.26 (1.06) = $9.68 million.

- If equity is underpriced by 5%, then to raise $9.5 million the firm will need to issue shares that are actually worth $10 million.

- (For example, if the firm’s shares are each worth $50, but it sells them for 0.95 $50 = $47.50 per share, it will need to sell $9.5 million $47.50/share = 200,000 shares. These shares have a true value of 200,000 shares $50/share = $10 million.)

- Thus, the cost of financing the project with equity will be $10 million.

- Evaluate:

- Comparing the three options, retained earnings are the cheapest source of funds, followed by debt, and finally by equity. The ranking reflects the effect of differences in information between managers and investors that result in a lemons problem when they issue new securities, particularly when issuing new equity.

Summary: Rules of Thumb for Optimal Capital Structure

- Make use of the interest tax shield if your firm has consistent taxable income.

- Balance the tax benefits of debt against the costs of financial distress. Financial distress may lead to other consequences that reduce the value of the firm.

- Consider short-term debt for external financing when agency costs are significant. Too much debt can motivate managers and equity holders to take excessive risks or under-invest in a firm. When free cash flows are high, too little leverage may encourage wasteful spending.

- Increase leverage to signal managers’ confidence in the firm’s ability to meet its debt obligations. Investors understand that bankruptcy is costly for managers.

- Be mindful that investors are aware that you have an incentive to issue securities that you know are overpriced. Thus, when an issue is announced, investors will lower their valuation of that security. This effect is most pronounced for equity issues because the value of equity is most sensitive to the manager’s private information.

- Rely first on retained earnings, then debt, and finally equity. This pecking order of financing alternatives will be most important when managers are likely to have a great deal of private information regarding the value of the firm.

- Do not change the firm’s capital structure unless it departs significantly from the optimal level. Actively changing a firm’s capital structure (for example, by selling or repurchasing shares or bonds) entails transactions costs. Most changes to a firm’s debt-equity ratio are likely to occur passively, as the market value of the firm’s equity fluctuates with changes in the firm’s stock price.

More detail is provided here: 🔎 The Bottom Line