✏️ EV Example

I tracked down a USF alum, a trader on the floor of the Pacific Coast Options Exchange, also known as the P. Coast. If the upstairs pukes wouldn’t have me, then I’d try the floor. Rob agreed to meet on Montgomery Street at ten. [They walk to the trading floor. It likely looked like a smaller version of this, but a bit more dated:]

Whatever Rob was saying, I didn’t understand it, but I gathered from the sound of his voice that he was struggling to make money. I was just taking it all in, standing at the edge of what Rob called the Microsoft pit. Someone walked into the crowd and shouted, then the crowd shouted back. The guy who walked into the pit started making allocations, giving one guy a hundred, two other guys fifty, then scraps for the rest. I had no idea what he was handing out, but everyone wanted it. They were like carp. I stayed clear of the feeding frenzy.

[Rob was presenting a limit order; saying, for example, that he would buy an option (we’ll learn about these later) for a specific price. He allocates his order to the people who want it. This is how exchanges used to work. You have to yell so you get “allocated” part of the order.]

[Jared networks a bit…]

A week later I’m interviewing with two of Tom Johnson’s traders.

“Let’s play a game,” one of them says. “You roll a six-sided die. If a one comes up, you win one dollar. If a six comes up, you win six dollars. The number of dollars you win directly corresponds to the number on the die. How much would you pay to play that game?”

You’ve got to be kidding me.

“Well,” I replied, “the expected value of that game is _________. So I would pay _________ dollars to play, but not _________. At _________, it’s a push.”

✔ Click here to see the full sentence

“Well,” I replied, “the expected value of that game is three-fifty. So I would pay three dollars to play, but not four. At three-fifty, it’s a push.”

I was hired.

So what would you say?

✔ Click here to view answer

At three dollars it is underpriced, so buy it!

At four dollars, it is overpriced, so sell it!

At 3.50, it’s a push. You should probably avoid it because of the risk (or take it for the thrill).

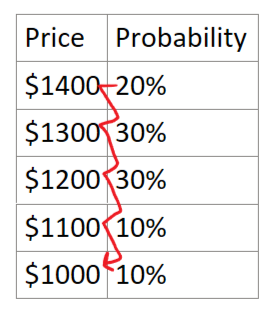

Suppose your analysis leads you think that the value of TSLA will be as follows next year:

Given the riskiness of TSLA stock, you feel that you would require a return. (Riskier stocks require higher returns.) Let’s assume that you expect a dividend next year. What is the fair price?

✔ Click here to view answer

← value of stock in future with no dividend.

←value of stock today with no dividend.

Value of dividend today

Total value of the stock today

Your target price for TSLA today is .

Buy it if it’s significantly less than . Short it if it’s significantly higher than . Ignore it otherwise.

🙋♂️ How do we get the probabilities?

Real world: Through “your analysis.”

This course: You’ll be given.

If you’re curious, the anecdote continues…

I clerked for Courtney, a mad chess genius and options whiz, on the day that Qualcomm got a price target from Walter Piecyk of Paine Webber. I entered 169 trade tickets by hand and was paid for my efforts. Courtney made .

He was my age.

I did not begrudge him his wealth. I was being paid a year to learn, and I learned everything there was to know. I learned about put-call parity, then about spreads, ratios, and butterflies. I learned about implied and realized volatility, what a “pickoff” was, how to trade stock, and how to intimidate people in the pit: I stood at parade rest and looked pissed off.

[We will cover spreads later. If studied carefully, the skills you learn can be equally applied to butterflies and even put-call parity. We will also learn a bit about the other subjects. [except intimidating people.]