✏️ Core example for this week

This page covers key equations for:

- Market Cap of combined company

- Number of new shares issued, exchange ratio, and shares of new company

- Share price of Acquirer, Target, and Combined after announcement.

It includes examples with and without a premium and with and without synergies.

Notation

Imagine AcquirerCo purchases TargetCo, using newly created shares of AcquirerCo’s own stock. AcquirerCo then merges TargetCo into itself, perhaps as a subsidiary. Once AcquirerCo purchases TargetCo, we will refer to it as CombinedCo. Therefore, if you read “AcquirerCo” in the following, it refers to AcquirerCo before the acquisition. If you read “CombinedCo” in the following, it just refers to AcquirerCo after it has purchased TargetCo.

- A, T and C are the market caps of the Acquirer, Target, and Combined Company.

- NA and NT are the number of shares outstanding of the acquirer and the target.

- NC is the number of shares in the Acquirer after they have issued new shares to purchase the target.

- x is the number of newly issued shares used to pay off the target’s shareholders.

- PA, PT, PC are the respective share prices.

Using our new notation, if we apply the definition of market cap to AcquirerCo, TargetCo, and CombinedCo, we get the following three equations. Please take a moment to read through them and make sure that they make sense!

In terms of mechanics, AcquirerCo will make an tender offer to the shareholders of TargetCo. TargetCo will put the offer to a shareholder vote. If the vote passes, AcquirerCo will create x new shares of AcquirerCo stock. It will then exchange these newly created shares for all shares of TargetCo’s stock. Now that it owns TargetCo, it will either transfer all assets of TargetCo into itself (including brand assets and human resources) or it will allow TargetCo to continue to operate as a subsidiary of itself. Either way, TargetCo will cease to exist as a separate entity, and TargetCo’s former shareholders will become AcquirerCo shareholders. (Though, as mentioned above, to keep notation simple, after AquirerCo has purchased TargetCo, we will refer to it as “CombinedCo.“)

Three Key Equations

We will use three key equations this week:

| Combined Market Cap | |

| Combined # of shares |

|

| New Share Price |

The most important number is the share price. The last formula allows us to calculate it by dividing the market cap by the number of shares outstanding.

To apply the last formula, we need the market cap and the # of shares outstanding. We calculate them using the first two formulas.

✏️ Example Problem: Movenin purchases Beenaround

- Consider two corporations that both have earnings of $8 per share. The first firm, Beenaround, is a mature company with few growth opportunities. It has 2 million shares that are currently outstanding, priced at $50 per share.

- The second company, Movenin Corporation, is a young company with much more lucrative growth opportunities. Consequently, it has a higher value: Although it has the same number of shares outstanding, its stock price is $80 per share.

- Assume Movenin acquires Beenaround using its own stock, and the takeover adds no value (ie S=$0).

Answer the following:

- In a perfect market, what is the value of Movenin after the acquisition?

- At current market prices, how many shares must Movenin offer to Beenaround’s shareholders in exchange for their shares? What is the exchange ratio?

- What is the share price of the combined company? What will the share price of both companies be right after the announcement? What was the return on Movenin and Beenaround stock on the day of the announcement?

- Finally, what are Movenin’s earnings per share after the acquisition?

Equation 1: C = A + T + S (🐈)

Remember:

- A, T and C are the market caps of the Acquirer, Target, and Combined Company.

The market cap of each firm is the NPV of the cash flows generated by the firm’s assets. It makes sense that when you combine A and T the value you get might be greater than the sum of A+T, due to synergies. If we use S to represent the dollar value of the synergies, we get:

Technically, we have defined S as a difference between C and A+T:S = C - (A + T). If you rearrange that formula, you get our CATS formula.

✏️1. In a perfect market, what is the value of Movenin after the acquisition?

- The first firm, Beenaround, is a mature company with few growth opportunities. It has 2 million shares that are currently outstanding, priced at $50 per share.

- Although Movenin has the same number of shares outstanding, its stock price is $80 per share.

- Assume the takeover adds no value (ie S=$0).

✔Market Cap of Beenaround = T = PT*NT = $50*2M = $100M

Market Cap of Movenin = A = PA*NA = $80*2M = $160

Market Cap of Combined firm:

Equation 2: NC = NA + x, where x = (1+ prem) / PA

Notation:

- NA, NT, and NC are the number of shares outstanding of AcquirerCo, TargetCo, and CCo.

- x is the number of newly issued shares used to pay off the target’s shareholders.

The acquirer will issue new shares in itself and trade those new shares for all of the shares in the target. We’ll use x to represent the total number of newly issued shares. x will be many millions of shares, because those shares will be used the purchase the entire target company, worth T.

AcquirerCo is offering to buy TargetCo, paying TargetCo’s shareholders with shares worth T, the entire market cap of TargetCo. It values each newly created AcquirerCo share at its pre-announcement price, PA. Therefore, it must deliver, in total, x shares, where

If, the acquirer is paying a premium of, say 30%, of the market cap of the company, the formula becomes:

The exchange ratio is the ratio between the total number of new shares and the total number of shares of the Target that the Acquirer is getting in return:

Exchange ratio = x/NT

With some algebra (→), we get:

This second formula allows us to see the Exchange ratio as the ratio of the share prices, with an additional premium.

During the acquisition, the acquirer will absorb the target as part of itself and the target will cease to exist independently. In other words, the combined company is really just the acquiring company - just bigger. Therefore, any existing shares will remain as shares of the acquirer/combined company. The total number of shares in the combined company will include both be the original shares and the newly created shares:

✏️ 2. At current market prices, how many shares must Movenin offer to Beenaround’s shareholders in exchange for their shares? What is the exchange ratio?

✔Using numbers from above and equation 2:

Also,

In other words, each share of Beenaround will be exchanged for .625 shares of Movenin. More realistically, every 8 shares of Beenaround will be cancelled and replaced by 5 shares of Movenin.

Equation 3: SharePrice

= MarketCap / #SharesOutstanding

From the perspective of corporate finance, the goal of the corporation is to create wealth for shareholders either by paying dividends or by raising the share price. Therefore, it is essential to be able to calculate the share price. (Note that shareholders may have environmental or other goals besides the creation of wealth. Maximizing shareholder value may just be a starting point.)

To calculate share price, remember that market cap is defined as

Therefore, with straightforward algebra,

In many problems, we are able to calculate market cap and number of shares outstanding, so we will often use this formula to calculate share prices. Applying this to the combined company,

✏️ 3. What is the share price of the combined company? What will the share price of both companies be right after the announcement? What was the return on Movenin and Beenaround stock on the day of the announcement?

✔ We already have the market cap of the combined company and the number of shares outstanding, using equations 2 and 3, so this step is a piece of cake.

Remarkably, the price of a share of AcquirerCo will not change after the merger. Beforehand it was $80 and after TargetCo is merged in, it will also be $80. This is because there were no synergies and no premium paid.

Because markets are efficient, and because a share in AcquirerCo will become a share in the combined company, immediately after the announcement, PA=PC=$80. Because a share in TargetCo will become .625 shares in the combined company, PT=.625*PC=.625*$80=$50.

Because both share prices are unchanged, the return on Movenin and Beenaround will be 0% on the day of the announcement.

EPS = Total Earnings / # Shares Outstanding

4. Finally, what are Movenin’s earnings per share after the acquisition?

✔ As stated in the slides:

- However, Movenin’s earnings per share have changed. Prior to the takeover, both companies earned

- The combined corporation thus earns $32 million.

- There are 3.25 million shares outstanding after the takeover, so Movenin’s post-takeover earnings per share are:

- By taking over Beenaround, Movenin has raised its earnings per share by $1.85.

- Because no value was created, we can think of the combined company as simply a portfolio of Movenin and Beenaround.

- Although the portfolio has higher total earnings per share, it also has lower growth because we have combined the low-growth Beenaround with the high-growth Movenin.

- The higher current earnings per share has come at a price—lower earnings per share growth.

Share price for the acquirer before and after the announcement

Equation 3 says that we can always calculate share price using market cap and shares outstanding

We can apply this formula before the acquisition to say that the share price of the Acquirer before the acquisition is:

Next, note that the market cap after the acquisition is: MC of the Acquirer after the acquisition is

# Shares Outstanding after the acquisition is , where x is the number of newly issued shares. (2M + 1.25M)

Therefore, the new share price after the acquisition is:

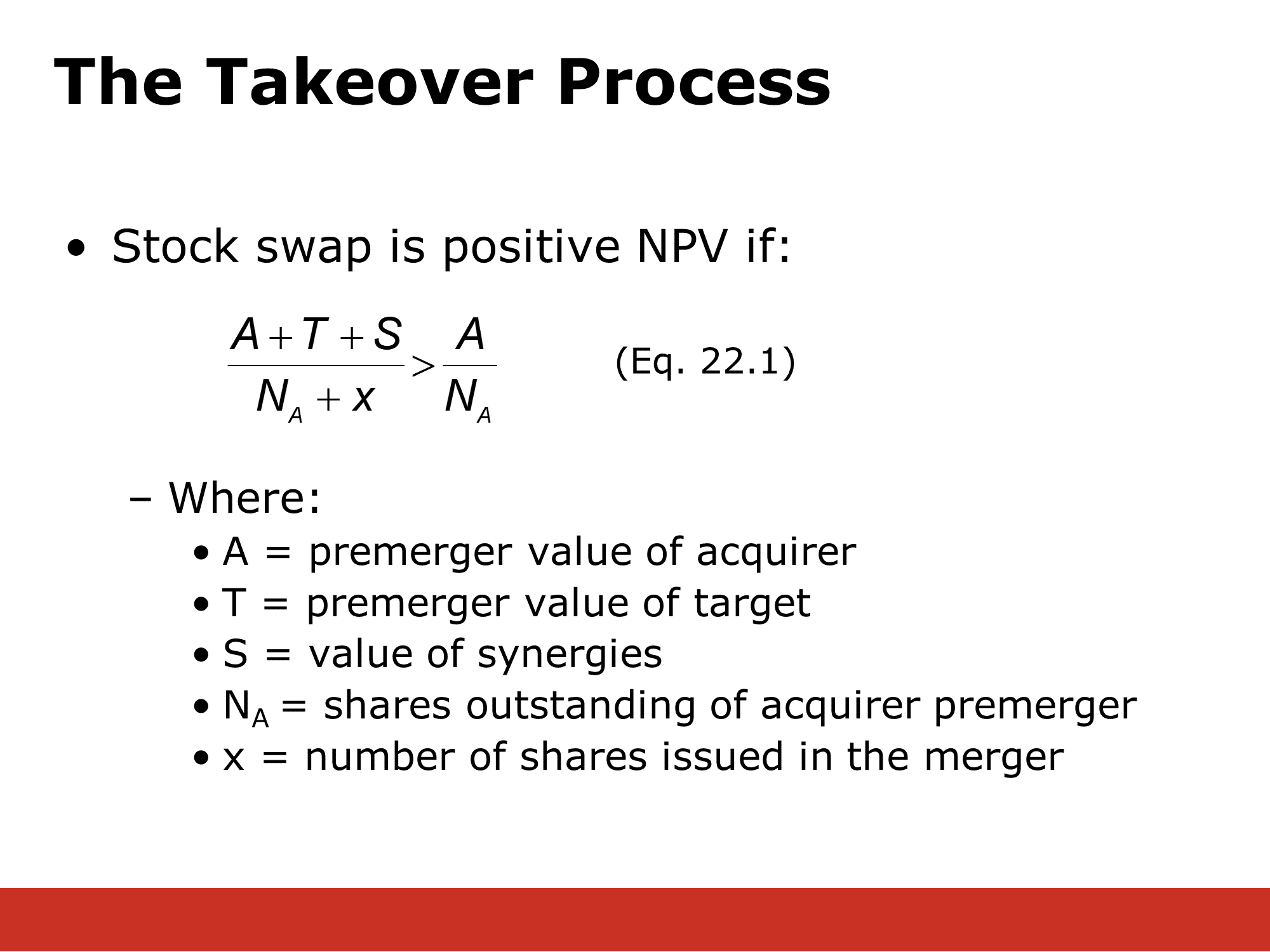

Clearly, the acquisition is profitable for the acquirer if the share price rises. In other words, the stock swap is positive if

Because and , the stock acquisition benefits shareholders of A if

This is exactly the formula introduced on the following slide:

Acquisition with synergies

✏️ Now, suppose there were $10M of synergies. Redo the first 3 steps of the problem.

✔ We just use the three formulas:

1.) Estimate the market cap of combined company = C = A + T + S

2.) The number of new shares to issue = x = T*(1+prem)/PA

3.) Estimate of the new share price PC = C/NC

C = A + T + S = $160M + $100M + $10 = $270M

x = T*(1+prem)/PA = $100M*(1+0%)/$80 = 1.25 million shares

Exchange ratio = x/NT = 1.25M / 2M = 0.625 shares

On the day of the announcement, Movenin’s shares will rise from $80 to $83.08. This is a gain of 3.08/80=3.85%. Beenaround’s shares will rise from $50 to PB= .625*$83.08=$51.93, a gain of 3.86%. Both company’s shareholders are better off because there was a $10M synergy.

Acquisition with premium and synergies

✏️ Now, suppose there were $10M of synergies and Movenin offers a 30% premium. Redo the first 3 steps of the problem.

✔ We just reuse the same three formulas:

C = A + T + S = $160M + $100M + $10 = $270M

x = T*(1+prem)/PA = $100M*(1+30%)/$80 = 1.625 million shares

Exchange ratio = x/NT = 1.625M / 2M = 0.8125 shares

(Note that the new version of x is exactly 30% larger than the old one: .625*(1+30%)=0.8125 )

PC = C/NC = $270M / (2M+1.625M) = 270/3.625 = $74.48

We can also use the combined formula, above, to calculate PC:

After the announcement, the share price of Movenin would immediately change to the share price of the combined company, because each share in Movenin would become a share in the combined company. The share price would drop from $80 to $74.48. This is because Movenin overpaid: the synergies were only 10% of the target’s value, but they paid a 30% premium. That’s too much!

As a result, if markets are efficient, Movenin’s share price will drop by ($74.48-$80)/$80=-6.9%

Each share of Beenaround will be replaced with .8125 shares of the combined company. Therefore, each Beenaround share is worth

PB= .8125*$74.48=$60.52

Beenaround’s shares will rise from $50 to $60.52, a return of ($60.52-50)/50=21%. They benefit from both the premium and the synergies.

🧠 (only if you’re curious)

←Here’s the algebra mentioned above:

Substituting x = T(1+prem )∕P_A , we get:

Substituting T=N_T P_T, we get:

Cancelling N_T and rearranging, we get: