✏️ Analyzing the Rights Issue

You are the CFO of a company that has a market capitalization of $1 billion. The firm has 100 million shares outstanding, so the shares are trading at $10 per share.

Under one program, you require either four rights to purchase one share at a price of $8 per share.

Under a second program, you require five rights to purchase two new shares at a price of $5 per share.

✏️ Suppose I have 100 shares. That means I receive 100 rights. How many shares can you purchase under each program. How much money will the firm raise from you?

✔ Click here to view answer

Under the first program, I can purchase shares.

Under the second program, I can purchase shares.

Just divide by the number of rights and multiply by the number of shares you get.

Under the first program, if I exercise my rights, they will raise

Under the second program, if I exercise my rights, they will raise

Suppose that you believe that the share price after the rights offering will be $9.

- In this case, under the first program, I pay $200 and get 25 shares in return worth . I’ve made a profit of $25.

- Under the second program, I pay $200 and get 40 shares worth in return worth . I’ve made a profit of $160.

✏️ Suppose the firm is only offering the second program and suppose we believe that 100% of rights will be exercised (for all 100M shares outstanding). What will the new share price be?

✔ Click here to view answer

Then, after the rights are exercised, the firm will have sold a total of:

40M

They will sell each share for $5, so they will raise of new financing.

Previously, the firm had been worth $1B. From the corporate finance perspective, we think of that firm as being a machine that produces cash flows. Those assets are still worth $1B. However, the firm now also has an addition $200M of cash on hand. Therefore, the new market cap should be

While that might seem basic, we can now begin to predict the new share price. To calculate the new share price, we’ll use the definition of Market Cap:

MarketCap = SharePrice NumberOfSharesOutstanding

Therefore,

SharePrice = MarketCap/NumberOfSharesOutstanding

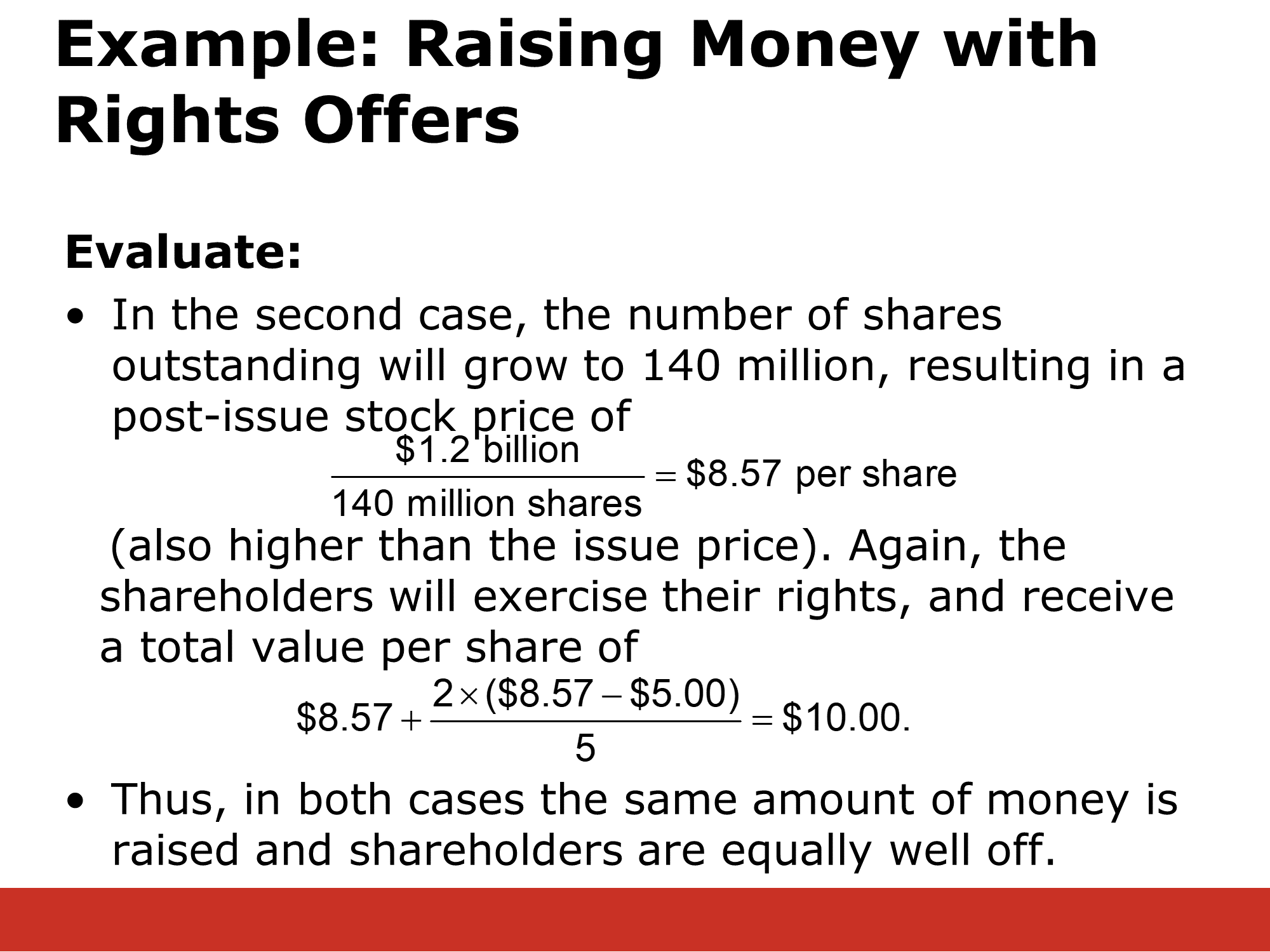

To predict the share price (this is what everyone wants), we just need to calculate the Number of Shares. There were 100M shares, and 40M new shares were issued, so the new number of shares is 140M.

SharePrice

Our best estimate of the new stock price is $8.57.

Suppose I have five shares. This gives me five rights. It takes five rights to buy two shares for $5 each. For each shares, I get five rights. By exercising those rights, I purchase something that will be worth $8.57 for only $5. Therefore, when purchase both shares, I make a total profit of because of the five shares I originally owned. Therefore, the rights offering gives me per right (and per share that I originally owned).

Profit from buying one share

Profit from buying both shares

Value of the rights issued to one share =

Total value of a share after the rights issue is announced = future share price + value of the rights issued to one share =

✏️ Suppose the firm is only offering the first program and suppose we believe that 100% of rights will be exercised (for all 100M shares outstanding). What will the new share price be?

Program 1: you require either four rights to purchase one share at a price of $8 per share.

✔ Click here to view answer

New shares purchased:

New shares sold

We will raise:

Money raised

The firm will now be worth There are now shares outstanding:

New share price:

SharePrice = MarketCap/NumberOfSharesOutstanding