🔎 What is a risk premium?

In this chapter, we heavily use expected returns.

- The expected return on unlevered equity is called the cost of capital of unlevered equity.

- The expected return on levered equity is called the cost of capital of levered equity.

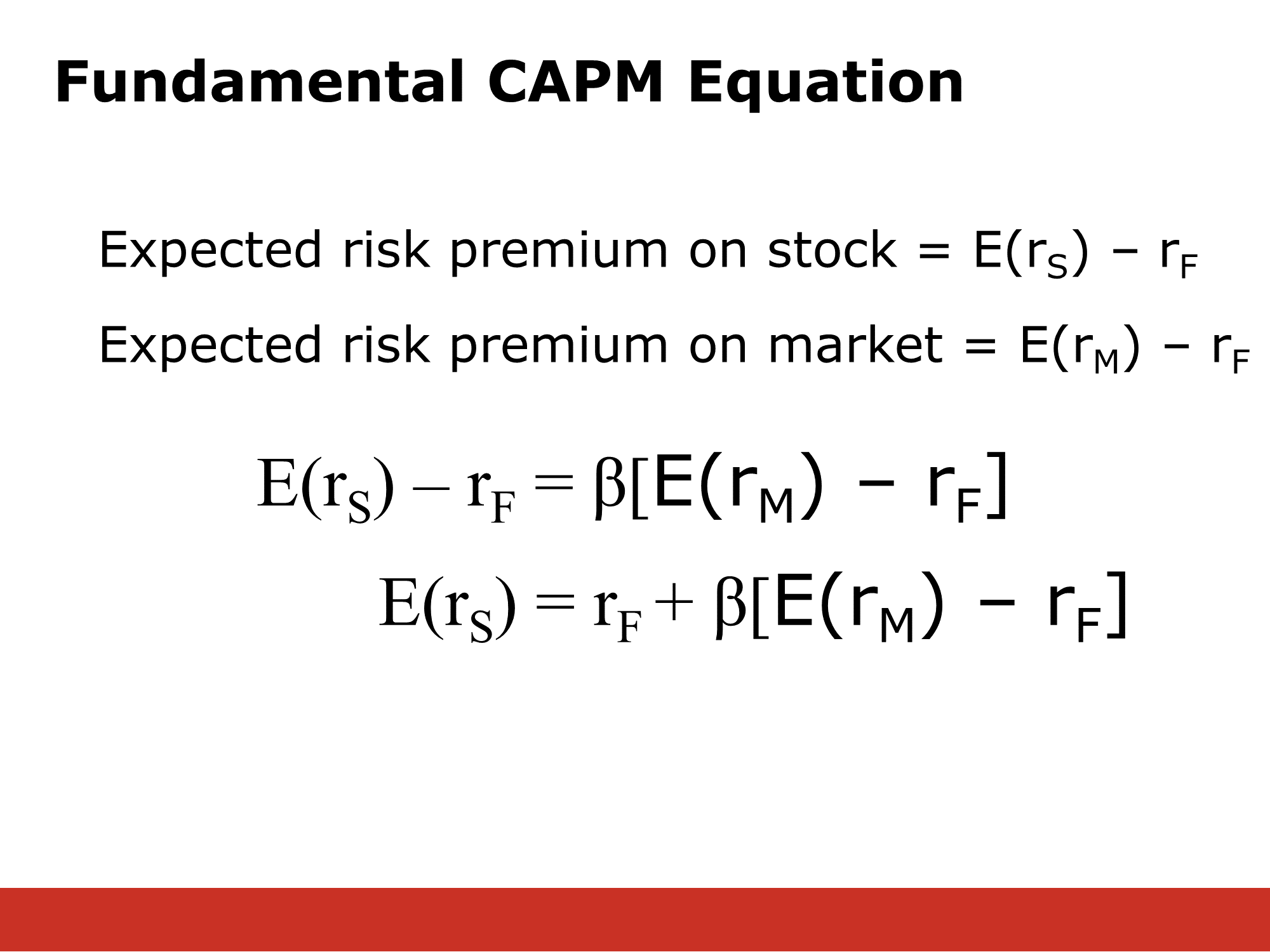

While the expected return and the cost of capital are synonyms, a risk premium is defined as the difference between an expected return and the risk free rate: (From Lecture 7)

According to the above slide,

If you add the risk free rate to both sides, you get

Bringing it all together, we get that: