🔎 Angel Investor vs Venture Capital vs Private Equity

❔ What is the difference between Venture Capital, Angel Investors, and Private Investors such as Institutional Investors and Corporate Investors?

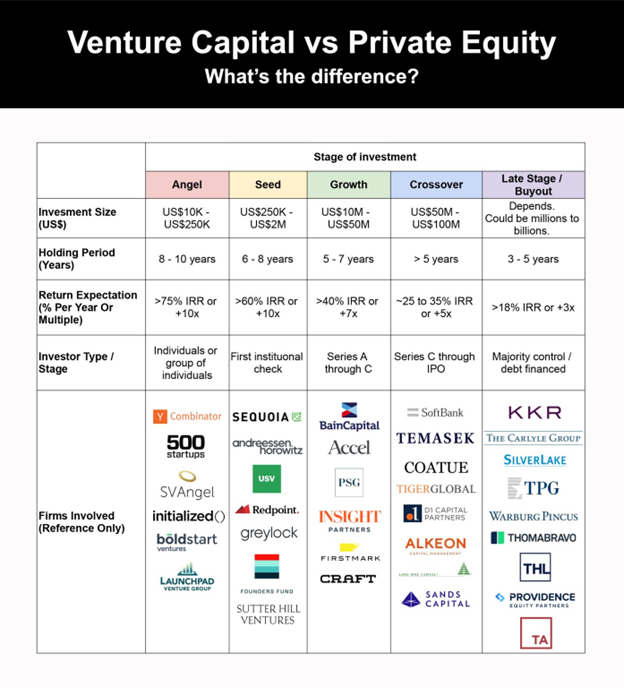

✔ As firms grow in size, from founding to public company, different types of investors will be willing to finance them:

- The Founder

- The Founder’s “Friends and Family”

- Angel Investors

- Venture Capital

- Private Equity Firms, Institutional Investors, and other Companies

- Public Markets

Let’s look at each of these in depth.

The Founder’s own funds and “Friends and Family”

Generally, the Founder first uses their own savings and then turns to the savings of their friends and family.

Who can legally invest? At this point, the firm is known as a “private company,” which severely restricts who the firm can raise money from. One way to legally qualify to be an investor in a private company is to be an “accredited investor,” which means you either earn $200K per year (or $300K with your spouse) or have a net worth of at least $1M. (The law assumes that such people can hire a financial advisor or otherwise protect themselves from being swindled.) There are additional exemptions, but they vary from state to state. A relatively simple guide through the thicket of regulations, applied to Ohio, can be found here.

Angel Investors

Once a startup has developed a product or is reasonably close to doing so, it may attract the attention of “Angel Investors.” These are high net-worth investors with experience as entrepreneurs and/or investors in small businesses. Angel investors typically bring value beyond cash in the form of mentoring/ coaching: advice, experience, contacts in the industry, and the ability to guide a business toward success and away from pitfalls. They take an active role in helping their investment grow via the success of the business.

Angel investors generally must be accredited investors, as described above. If you are interested in being an Angel Investor, I found David Rose’s book to be credible. Angel investors often join together in Syndicates, allowing them to pool capital to take on larger investments. A list of Boston Angel groups can be found here.

Venture Capital

These firms approach larger businesses, and have the resources to vet their investments. This due diligence allows them to more confidently invest larger volumes of capital and be more selective about which businesses to back.

Some of the most famous VC firms are associated with Silicon Valley. Many of today’s and tomorrow’s most famous tech firms received significant venture capital funding.

Institutional and Corporate Investors

At this stage, the firm may also court investments from large institutional investors, such as endowment or pension funds, or from individual large corporations in similar lines of business.

Private Equity

These firms look for more mature businesses, perhaps ones nearly ready to go public on a stock exchange in which to invest. The volumes of these businesses in the tens or hundreds of millions of dollars, are beyond the reach of the average investor and investments may take years to mature. Target investments have proven sustainable business models, profitability, and are looking to expand or improve efficiency rather than being given a chance to prove their business will be successful.

Public Markets: the IPO

The most successful startups eventually get to the point where they want to “go public.” Once they do the paperwork to register their offering with the SEC, they can list their securities on a public exchange and sell their stock to anyone in the world. Up until this point, they are known as a “private company” rather than a “public company.”

Companies can use going public either as an opportunity to raise new capital or for their earlier private investors to cash out (the founders, friends and family, angels, VCs, institutional investors, corporate investors, and private equity). Angel Syndicates, VCs, and PEs, will be eager to cash out to return their money to their investors.

Other Sources

- An overview, from an industry perspective, can be found in this LinkedIn post.

- Perspective from a Law firm (Lawyers, like economists, often get the lay of the land, even if you won’t turn to them for investing tips)

- Perspective from the SEC

- Fundable

- The aforementioned LinkedIn post contains the following graphic, which lists several of the largest players: