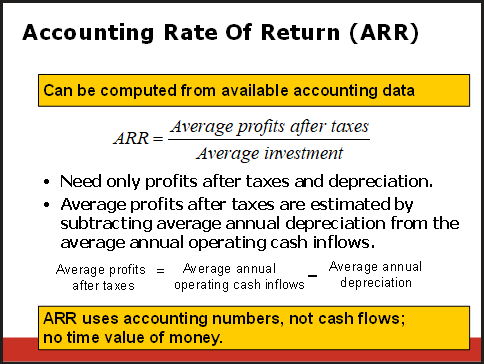

In general, we don’t like ARR because it doesn’t respect the time value of money. Therefore, we won’t spend much time on it.

To some degree, this slide is here to remind us that it is important to account for the Time Value of Money. See the video accompanying the following page for more: [Two measures of profit - Cash Flow vs. Net Income]() 🔗

ARR comes down to two equations:

ARR=AverageinvestmentAverageprofitsaftertaxes

Averageprofitsaftertaxes=Averageannualoperatingcashinflows−Averageannualdepreciation

Plug and chug: (help)

- Equation →

- Plug 🔌 →

- Solve 🚂 →

- 🧠 →

Simplest Example:

❔ What was Apple’s ARR. Assume that Average Annual Deprec. is 10,000M. You have the opportunity to lease “Apple” for 3 years for and annual cost of 233B.

✔ Click here to view answer

AverageProfitsAfterTaxes=AvAnnOperatingCashInflows−AvAnnDepreciation=102,288−11,148=91,140

ARR=AvgProfitAftTax/AvgInvestment=91,140/233,000=0.3912